Dropshipzone General Manager John Barkle explains why B2B marketplaces will continue to rise in popularity and inventory-free retail is the solution for Aussie SMEs.

The wholesale model is broken. Even worse, it’s failing Aussie SMEs operating online stores. Fortunately, there’s another way of accessing inventory – and it doesn’t involve accessing any physical inventory. No, this isn’t the metaverse.

Still today, in 2022, brokers and trade shows are the main channel for suppliers selling merchandise to retailers. Meanwhile, retailers are accustomed to buying in bulk and committing to traditional wholesale deals – even when they’re just starting out – where the economics just don’t add up.

Discovering new products often means travelling to trade shows, which is more difficult in a post-COVID world. This old-school distribution model is expensive and inefficient for suppliers and retailers alike

Then, there’s the lingering effects of COVID-19 supply chain issues, coupled with high rates of inflation. If the traditional wholesale model wasn’t already at breaking point, you can bet your bottom-dollar that it certainly is right now.

The rise of the B2B marketplace

It’s no wonder we’re seeing the rise of the B2B marketplace.

They say necessity is the mother of all invention, and it was through the years of COVID-19, with industries starved of face-to-face interaction, that B2B marketplaces came under the spotlight.

B2B marketplaces are the fastest-growing ecommerce channel. In 2021, B2B marketplace sales grew 7.3x faster than B2B ecommerce sales, and 8.5x faster than total distributor and manufacturer sales across all channels.

Recent research from Shopify revealed that 86 per cent of B2B buyers preferred using self-service tools as opposed to contacting sales. B2B buyers want to research and buy within the same channel without having to speak to a sales representative.

B2B marketplaces are big business. According to McKinsey, two-thirds of B2B buyers prefer remote human interactions (such as video calls) or digital self-service – even for $1 million+ purchase decisions. This isn’t a pandemic workaround. It represents a generational shift.

From Amazonian expectations to Generation Alpha

All you have to do is take one look at the recent Australian Census to understand the driving factors behind the rise of the B2B marketplace.

Digitally-native Millennials have now surpassed Baby Boomers on an Australian population level. It happened faster than almost anyone anticipated. Millennials aren’t only buying the purse, they’re also holding the purse strings.

As Millennials, Generation Z and ultimately Generation Alpha – it will happen in the blink of an eye – make their way into procurement and management jobs, they will take their Amazon-like B2C expectations into their B2B roles.

Wholesale is seriously behind the B2C world, where consumers can search and order within a few clicks. But B2B trends follow B2C. And the ‘consumerification’ of B2B is the recognition that B2B buyers are people first and foremost.

Especially in Australia, where the majority of retail businesses dealing with wholesalers are in fact small businesses employing fewer than 20 people.

We’ve known for some time that small business is the backbone of Australia and it’s showing no signs of slowing down. Between 2020-21, breaking it down by business growth across all industries, retail trade experienced the second-highest growth rate after healthcare. This factors in business entry and exit rates, and includes brick-and-mortar business as well as online businesses.

In online retail, Gen Z is also driving the shift to social commerce, where the barriers to entry in business are even lower.

It’s almost as if we’re seeing a shift from B2B to B2b – the small ‘b’ is intentional here – and the future Australian B2B buyer looks a lot like the future Australian consumer. Actually, nearly identical.

And, in B2C, Aussies just can’t get enough of marketplaces. Among consumers who shop online once a week or more – ‘power shoppers’ as Mirakl calls this group – they’re increasingly more likely to shop on marketplaces.

What’s more, there’s a widening gap in buying behaviour between the average Aussie consumer and their counterpart power shopper when it comes to shopping on marketplaces. This is even more pronounced when you do a global comparison. The Aussie power shopper does 45 per cent of their online shopping on marketplaces, while the average Aussie consumer does a little over 30 per cent. This indicates that as Aussies shop online more, they also spend more on marketplaces. What did we say about B2B following in the footsteps of B2C?

The shortcomings of B2B marketplaces

But I confess, B2B marketplaces aren’t perfect.

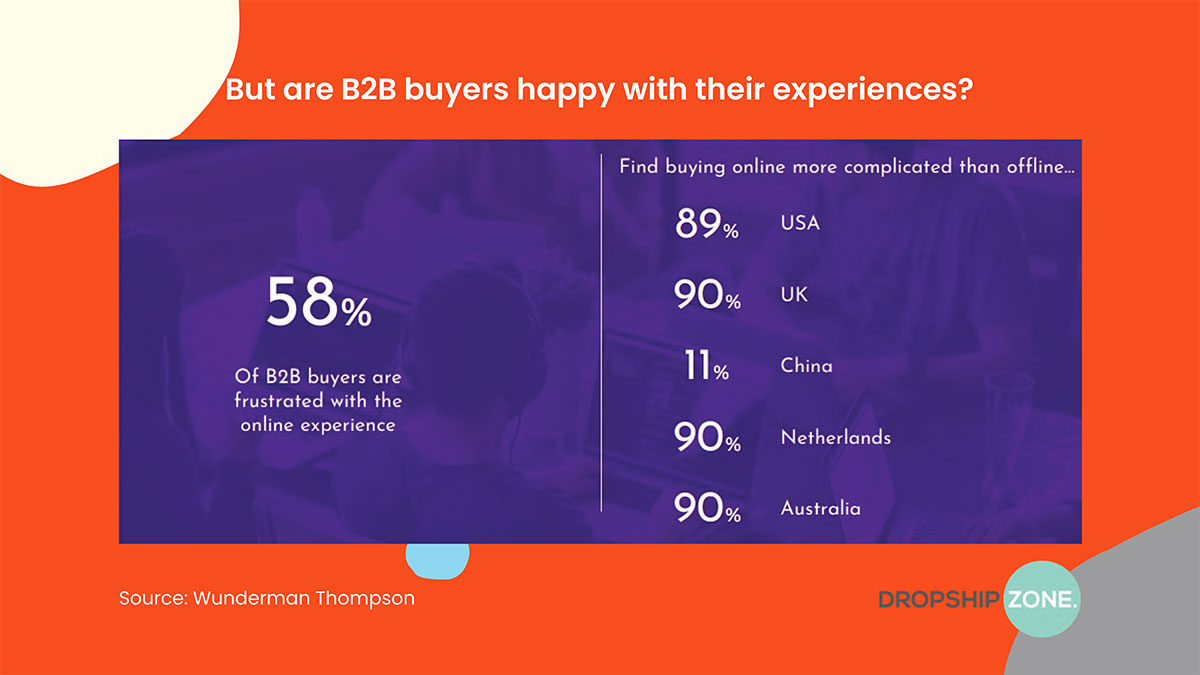

We still have a way to go in optimising the experience. Despite the fact that B2B marketplaces are the fastest-growing digital sales channel, Aussie B2B buyers are left feeling mostly unsatisfied with their online experiences.

Rightly so, business buyers want all the same things they have as consumers: faster delivery, easier returns, and more product choices.

At Dropshipzone, we believe much of this begins with innovation in the fulfilment method.

At the moment, many B2B marketplaces operate with offshore warehousing, or still force retailers to take on physical inventory. Products take a long time to arrive, and when they don’t sell, retailers get stuck with the products (and sometimes the debt). Even when products do sell well, smaller retailers often can’t afford to buy enough inventory or have enough warehouse space to keep up with demand.

The problem comes from the fact that many B2B marketplaces were built on the same broken system that I mentioned earlier. Innovation must come from first principles thinking.

Holding inventory is tough, even for the giants of industry. In the US, excess inventory has taken a toll on the earnings and cash flow of traditional retailers including Target, Abercrombie & Fitch, and Walmart recently. Even direct-to-consumer businesses like Peloton are battling inventory issues. The company let go of 2,800 people in February, as a result of investing heavily in near-term inventories and logistics.

Why inventory-free retail is the solution

B2B marketplaces simplify, streamline and scale the sales process for suppliers and retailers – if they’re built on solid foundations with the right integrations.

That’s why we make sure every supplier on Dropshipzone holds stock locally in Australia. This means faster shipping from the supplier to the customer.

With APIs and third-party integrations, a retailer can upload this stock easily to their online store.

It’s held as digital inventory. Once a customer places an order, the retailer pays the supplier for the product. This frees up working capital tied to holding physical inventory, so retailers can invest in other areas of their business – like staff, growth and marketing.

Back in the day, when Dropshipzone started talking to small retailers in 2012, I’m told it was immediately clear there was a gap in the market. Retailers loved experimenting with products, but the upfront capital and risk of getting stuck with unsold stock was holding them back.

Businesses today face many of the same issues as their customers. With the price of electricity and fuel going up, retailers need to make cost savings all around – including on buying and holding stock – to improve their working capital.

Wayfair, one of the internet’s biggest furniture stores, is a dropshipper working with a network of thousands of suppliers. Foot Locker announced a new dropshipping program with Nike last quarter, while major department store Nordstrom in the US said during a recent investor day that it plans to carry more products on a dropship basis going forward. The dropship fulfilment method is here to stay.

It sounds like an oxymoron, but inventory-free retail is perfectly compatible with online retail. While dropshipping might not be the answer for every retail business, it’s a solution for those keen to embrace change – and any business who would rather keep cash in the bank rather than tied up in stock.